PRINCIPLE EIGHT – RELATIONS WITH SHAREHOLDERS AND OTHER KEY STAKEHOLDERS

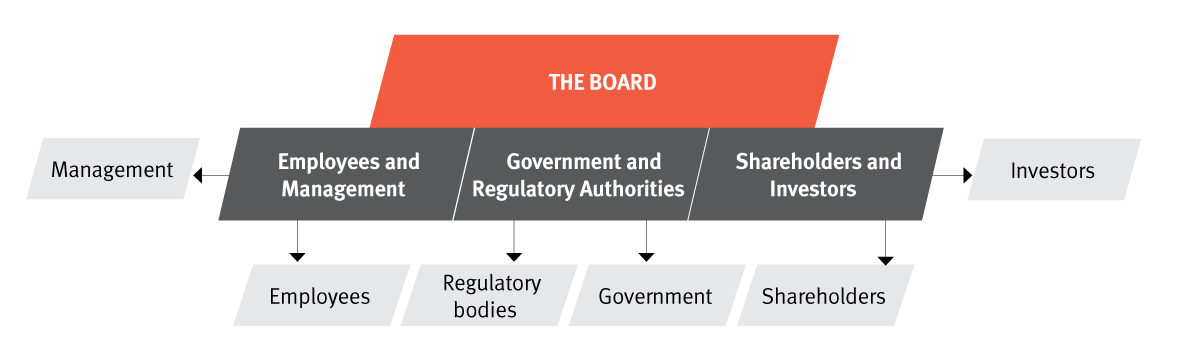

ABL’s stakeholders are individuals or groups that have an interest in the Bank or are affected by its actions. The primary stakeholders of the Bank are employees and management, shareholders and investors, and government and regulatory authorities.

SHAREHOLDING STRUCTURE

The Bank's shareholding structure as at 30 June 2020 is as follows:

AfrAsia Bank has a good mix of local and international private institutional investors of renowned reputation across various continents and had a capital base of MUR 8.4bn as at 30 June 2020. The Bank ensures that there is proper and efficient information dissemination to all its shareholders and that the rights of minority shareholders are not neglected. It is noted that 0.32% of the Bank’s shareholding is held by its staff.

DIVIDEND POLICY

Dividends are proposed by management to its Board in line with the provisions of The Banking Act 2004 (amended August 2020), the “Guideline on Payment of Dividend” issued by BOM, The Companies Act 2001 of Mauritius and the Bank’s Constitution. Once the Board is satisfied with the Bank’s recommendation and once the solvency tests are met, approval of the Bank of Mauritius is then sought prior to distribution to shareholders.

Dividend on Ordinary Shares

The Bank has achieved a satisfactory financial return to allow dividends of MUR 429.3m (MUR 3.80 per share), declared and paid during the year under review (2019: MUR186.4m that is, MUR 1.65 per share /2018: MUR160.2m that is, MUR 1.50 per share). This can be summarised as follows:

| Dividends on Ordinary Shares (MUR’m) | |||

|---|---|---|---|

| 2020 | 2019 | 2018 | |

| Dividend paid | 429.3 | 186.4 | 160.2 |

Dividend on Class A Shares

Dividend of MUR 73.7m were paid for the 6 months ended 31 December 2019 and MUR 73.7m for the 6 months ended 30 June 2019 (MUR 74.9m were paid for the 6 months ended 31 December 2018 and MUR 72.2m for the 6 months ended 30 June 2018). This can be summarised as follows:

| Dividends on Class A Shares – Series 1 and 2 (MUR’m) | |||

|---|---|---|---|

| 2020 | 2019 | 2018 | |

| Dividend paid | 147.4 | 147.1 | 140.0 |

Please refer to the note on “Retained Earnings and Other Reserves” contained on Note 31 of the Annual Report

Article 21.2 of the Bank’s Constitution provides for a list of reserved matters which must be approved by special resolution of the voting shareholders of the Bank.

Restrictions concerning the disposal of shares are set out in Articles 15 and 16 of the Bank’s Constitution. Such restrictions include the requirement to obtain the Board’s approval in connection with the registration of share transfers.

As regards the Shareholders Agreement, three out of the four shareholders who are parties to the Agreement have terminated the Agreement by notice. The termination is, however, being disputed by one shareholder by way of arbitration and the matter will now be heard by the International Court of Arbitration in April 2021.

ABL has not entered into any significant contract with third parties during the financial year ended 30 June 2020.

ABL has not entered into any management agreement with third parties during the financial year ended 30 June 2020.

The Bank has made MUR 2.0m of gifts and donations during the year ended 30 June 2020 (2019: MUR 0.8m / 2018: MUR 1.5m).

The Bank has made political donations of MUR 3.5m during the year ended 30 June 2020 (2019 and 2018: Nil)

Please refer to the note on “Related Party Disclosures” contained on Note 36 of the Annual Report.

OUR KEY RELATIONSHIPS

EMPLOYEES AND MANAGEMENT

We continue to take a proactive approach towards our relations with primary stakeholders. When selecting suppliers, contractors or non-governmental organisations, we look for those that align closely to our values and areas of focus.

We offer a variety of ways for stakeholders to interact with us and provide feedback; we use this information towards understanding what is going well and improving areas of concern. We regularly review how we communicate with our stakeholders to ensure it is still appropriate in an ever-changing fast-moving world.

Below is an overview of our main stakeholders and how the Bank engages with them:

HOW WE ENGAGE WITH OUR STAKEHOLDERS

- Face to face meetings

- CEO town halls

- Social events/activities

- Training and coaching

- External learning and growth opportunities

- Committees

- Recognition and rewards

- Engagement Surveys/Pulse Checks

- Breakfast meetings with EXCO

- Virtual workshops and meetings

THEIR CONTRIBUTION TO VALUE CREATION

- Work towards achievement of our strategy - Key Performance Indicators

- Demonstrate passion towards a positive customer experience

- Help create and build positive working relationships

- Enhance trust on the market

- Help create a positive employer and corporate brand

WHAT OUR STAKEHOLDERS EXPECT FROM US

- An environment that encourages growth and open communication

- The opportunity to achieve personal goals whilst aligning to the Bank’s objectives

WHAT CONCERNS OUR STAKEHOLDERS

- A safe and healthy place to work

- Continued career growth

- Open door management style; with mutual trust

- A positive work culture

- Sustainability and CSR actions

- Regular feedback and coaching

- Competitive remuneration

- Financial and non-financial rewards

- Recognition

- A high level of empowerment and autonomy

SHAREHOLDERS AND INVESTORS

HOW WE ENGAGE WITH OUR STAKEHOLDERS

- Engage with all stakeholders on building a sustainable business

- Regular presentations

- AfrAsia Bank Sustainability Summit

- External workshops and seminars

- Newsletters

- Integrated reports, media releases and published results

- Board meetings

- Annual general meetings

- Investor relations

- Sustainability and CSR microsite

- Social media platforms

- Virtual conferences and seminars

THEIR CONTRIBUTION TO VALUE CREATION

- Investors provide the financial capital necessary to sustain growth

WHAT OUR STAKEHOLDERS EXPECT FROM US

- Providing sustained returns on investment through sound risk management, strategic growth opportunities and good governance practices

WHAT CONCERNS OUR STAKEHOLDERS

- Sustainability issues (Environment, Social, Economic)

- Delivering sustainable returns

- Leadership and strategic direction

- Corporate governance and ethics

- Progress with project pipelines, business plans and future growth initiatives

- A high level of employee engagement, empowerment and autonomy, a positive employer brand

GOVERNMENT AND REGULATORY AUTHORITIES

HOW WE ENGAGE WITH OUR STAKEHOLDERS

- Regular meetings

- Workgroups with Bank of Mauritius and Financial Services Commission on regulatory guidelines, new legislations, laws and other matters

- Written communication

- Regulatory returns

- Onsite and offsite supervision by the regulators

- Trilateral meeting between the Bank of Mauritius, External Auditors and the Bank

- Regulatory approvals

- Providing information during Parliamentary debates through the Mauritius Bankers Association, Business Mauritius and National CSR Foundation

- Virtual Committees and conferences

THEIR CONTRIBUTION TO VALUE CREATION

- The regulator provides the enabling regulatory framework

- Guidelines and instructions from the regulators issued from time to time

WHAT OUR STAKEHOLDERS EXPECT FROM US

- Providing banking and financial services in a transparent, secure and sustainable way

- Ensuring and maintaining customer satisfaction

- Complying with acts, regulations and guidelines

WHAT CONCERNS OUR STAKEHOLDERS

- Products and services being provided and the communication around same

- Compliance with laws, acts and regulations

- Transparency and accessibility to accurate, relevant and current information

- The Bank’s duty of confidentiality and data protection

- Duties of the Board and senior management

- Appropriate Customer Due Diligence and Know Your Client (KYC) processes and reviews

- Risk management and internal controls

- Complaints handling and customer care

- Compliance with the principles of corporate governance

- Sustainable financing

SOME KEY DATES

SHAREHOLDERS’ CALENDAR

-

Financial Year End

June

-

Annual Meeting of Shareholders

December

PUBLICATION OF FINANCIAL STATEMENTS

-

30 September quarter end

November

-

31 December quarter end

February

-

31 March quarter end

May

-

30 June year end

September or any other dates permitted by the Bank’s regulators

DIVIDENDS

Ordinary shares Dividends

-

Declaration

Post 30 June 2020 upon closure of accounts

-

Payment

Upon receipt of approval from local regulators

Class A Shares Dividends

-

Payment

Post June and December

Upon receipt of approval from local regulators, post June and December

The Annual Report is published in its entirety on the Bank’s website. (https://www.afrasiabank.com/en/about/investors/annual-reports).

The Corporate Governance Report have been approved on behalf of the Board of Directors:

INDERJIT SINGH BEDI

Interim Chairperson

SANJIV BHASIN

Chief Executive Officer

Date: 19 November 2020