- Home

- Section A

- MANAGEMENT DISCUSSION AND ANALYSIS

MANAGEMENT DISCUSSION AND ANALYSIS

Foreword

While the health crisis we are confronted with supersedes all other topics in this year’s annual report, the core principle of value creation during the economic disruption as we deal with the spiraling effects of this pandemic remains of top priority in the Bank’s agenda. We have vowed to keep clients at the absolute center of everything we do as we go all out in delivering tailored services, adapted advice and consequential capital to path our clients towards success and their ultimate well-being.

Highlights for the year under review

BUSINESS SEGMENTS REVIEW

TREASURY & MARKETS

ACHIEVEMENTS IN THE FINANCIAL YEAR (“FY”) 20

Major Business Segment’s Achievements

Treasury and Markets’ gross operating income grew by 9% year-on-year, spearheaded by a record performance on the Trading Income side. Trading Income finished in excess of MUR 1.2bn, showcasing a year on year growth of 35%. We saw solid performance on both the FX side and the Money Markets/Fixed Income side of the business, supported by our Structuring desk. Indeed, the bank closed a landmark deal being the first ever USD/MUR Cross Currency Interest Rate Swap (“CCIRS”) in the Mauritian market. Given a sudden reversal in market interest rates, the Treasury and Markets team was also able to position the balance sheet so as to limit the adverse impact of the reduction in interest rates - further shoring up Net Interest Income performance for the bank. The Treasury and Markets team also closed the IBL Bond Issuance mandate for a total amount of MUR 4bn.

Our Strategy

Below is our proposition by unit:

- Treasury: To be the most innovative and avant-gardist Treasury on the island;

- Financial Institutions: To have well diversified and high-quality Financial Institutions partners;

- Custody and Securities Services: To be the best Custody Services provider with state-of-the-art infrastructure; and

- Debt Capital Markets (“DCM”): To be the go-to Bank for local DCM Mandates.

The four key pillars within the Treasury and Markets cluster are Treasury, Financial Institutions, Custody and Securities Services and Debt Capital Markets. Our goal is to ensure that our client facing and support functions are aligned to consistently provide our clients with best in class services. Treasury and Markets’ prerogative is to provide clients with tailored solutions by reinforcing ABL’s position as the market makers for foreign exchange, interest rate, debt, and other structured derivatives. ABL further consolidates its stance as an innovative Financial Markets service provider catering not only to Mauritian demands but also effectively meeting financial requirements in the regional sphere.

Its local expertise, global access and balance sheet scale allows the Bank to provide clients with a range of financial instruments to meet their risk management, investment and trading needs. Managed by a team of professionals with decades of experience, Treasury and Markets is committed to satisfy its clients’ commercial and investment needs.

The Core Ideas

WE AIM TO FOSTER A “TRADING CULTURE” IRRESPECTIVE OF ASSET CLASS, BY INCREASING THE NUMBER OF IN-HOUSE TRADERS. UP-SKILLING OF OUR HUMAN CAPITAL AND RESEARCH IS AT CORE OF THIS STRATEGY, DRIVING ECONOMIES OF SCALE IN THE LONG RUN.

A FLEXIBLE AND NIMBLE APPROACH TO RISK MANAGEMENT AND A CONSTANT DIVERSIFICATION STRATEGY, ENABLING THE BANK TO FULLY EMBRACE THE CHALLENGES BROUGHT UPON BY THE COVID-19 PANDEMIC.

EMBARKING ON THE DIGITALISATION JOURNEY OF OUR CUSTODY & SECURITIES SOLUTIONS PLATFORM. WE EXPECT ROLL-OUT OF THE PLATFORM IN FY 21.

The Future

The future is riddled with uncertainty. Other than a global recession, the COVID-19 pandemic has created significant turmoil in global markets whereby we are expecting to see increased volatility in financial markets for the foreseeable future. The severe contraction of the local economy coupled with potential EU sanctions on the Mauritian jurisdiction, will also present another set of challenges for the banking sector. Given the increasingly challenging landscape, our focus shall be on shoring up risk taking by adopting a “Risk and Capital” preservation strategy, as prescribed by our Board. We nevertheless remain ready to support our stakeholders and will keep abreast of market developments, so as to identify the right opportunities.

ECONOMIC OUTLOOK

On 1 September 2020, of the 25,298,875 cases reported globally so far, 53% are in Americas. This is followed by Europe and South East Asia with 4.2m cases respectively. The number of deaths stood at 847,602 which were mainly caused by community transmission.

Coronavirus has already impacting global markets, with economic impacts felt beyond China and other effected countries. Stock indices tumbled, spooked by reports that the coronavirus outbreak that emerged in China is spreading to countries including Italy, Iran and South Korea. Trading in stocks across world markets remained choppy, reflecting hope that the economic fallout might be manageable. The markets’ movements mirror the uncertainty that prevails and persists not just in the U.S. but all over the world. Several weeks into the coronavirus outbreak that has brought the world’s second-largest economy to its knees, some of the most basic aspects of the virus remain unknown.

In its June 2020 report, the IMF projected that the global growth will shrink to –4.9% in 2020, as compared to 2.9% in 2019. The COVID-19 pandemic has had a negative impact on activity in the first half of 2020, and the recovery speed is uncertain.

However, it is important to acknowledge that the global economy was already facing some difficulties prior to the COVID-19 pandemic.

Since 2019, there was a perceived sentiment that a recession might be underway. The global 2019 growth rate was forecast to be 3.2%1 , but the actual rate was 0.3% lower. In addition, there were escalating tensions between the United States of America and China on multiple fronts and widespread social unrest posed challenges to the global economy. Due to the slowdown of several economies, central banks across the globe began to reduce interest rate to stimulate consumption and investment. For example, the 3-months USD Libor decreased from 2.26% to 0.31% in one year (as shown below).

1 https://www.imf.org/en/Publications/WEO/Issues/2019/07/18/WEOupdateJuly2019

With the emergence of the COVID-19 pandemic and as a result, many countries went into lockdown, global activities came to a near standstill. This has induced an economic recession worldwide. The synchronized nature of the downturn has amplified domestic disruptions around the globe. Trade contracted by close to –3.5 percent (year over year) in the first quarter of the calendar year. This reflects the weak demand, the collapse in cross-border tourism, and supply dislocations related to shutdowns (exacerbated in some cases by trade restrictions).

https://www.imf.org/en/Publications/WEO/Issues/2019/07/18/WEOupdateJuly2019

In most recessions, consumers dig into their savings or rely on social safety nets and family support to smooth spending, and consumption is affected relatively less than investment. But this time, consumption and services output have also dropped markedly. This is due to lockdowns needed to slow transmission of the disease, steep income losses, and a general weaker consumer confidence. Firms have also cut back on investment when faced with precipitous demand declines, supply interruptions, and uncertain future earnings prospects. Thus, there is a broad-based aggregate demand shock, compounding near-term supply disruptions due to lockdowns.

Hence, this pandemic required a high level of state intervention that the world hasn’t even seen in wartime. Governments worldwide implemented several support and relief measures coupled with regulatory forbearance measures to assist their economic operators. There have been numerous fiscal measures to support ailing business, the self-employed and employees who have been (partly) laid off because of the virus. For instance, the United States of America support package was equal to 12% of its GDP.

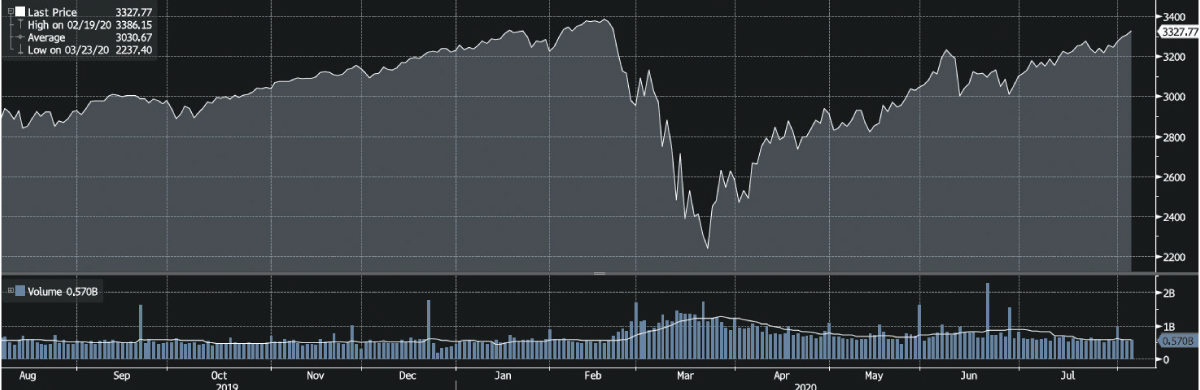

The Financial Markets

Due to the liquidity concerns and the general uncertainty about the magnitude of the crisis, equity markets plunged at the beginning of the crisis (Refer to graph below). However, the recent rebound in financial market appears to be ahead of the economic prospects. Yet, the environment remains volatile and uncertain.

The Ongoing Health concern

COVID-19 continues to impact several countries and medical breakthroughs with therapeutics and changes in social distancing behavior might allow health care systems to cope better without requiring extended, stringent lockdowns. Vaccine trials are also proceeding at a rapid pace. Development of a safe, effective vaccine would lift sentiment and could improve growth outcomes in 2021.

Beyond the pandemic, policymakers must cooperate to resolve trade and technology tensions that endanger an eventual recovery from the COVID-19 crisis.

THE MAURITIAN ECONOMY

Outlook

The COVID-19 pandemic started as a sanitary crisis but soon became a global multidimensional crisis. Global economies have been badly hit including Mauritius. The IMF forecasted the Mauritian economy to contract to -7% for 2020 . Even though Mauritius has a diversified economy , it nevertheless remains vulnerable to global economic trends. Due to the lockdown and closure of our borders, many of our sectors like the tourism, manufacturing and trade industries have been badly impacted.

However, over the past few months, we have seen substantial support from the Government of Mauritius and the Bank of Mauritius (as shown below). The government has used fiscal stimulus and eased monetary policies in order to support our economic operators during this unprecedented time. Through the Government support measures, we have observed the prevention of large-scale bankruptcies in the economy. The setting up of the Mauritius Investment Corporation Ltd (“MIC”) by the Bank of Mauritius further complements the Bank’s Support Program. The main objectives of the MIC are to support employment, investment and exports.

| Year | Period Description | Mauritius GDP Growth |

|---|---|---|

| 2008 | Pre-Financial Crisis | 5.40% |

| 2009 | Financial Crisis Impact | 3.30% |

| 2019 | Pre COVID-19 | 3.60% |

| 2020 4 | COVID-19 Impact | -6.80% |

SUPPORT PROGRAMME

| TOURISM/MANUFACTURING: | MUR 3bn |

| AGRICULTURE: MUR 1bn and SMEs: | MUR 1bn |

The ratio for MUR was reduced from 9% to 8%.

A moratorium of 9 months on capital should be granted for deferral requests or extension of existing facilities.

BOM put on hold the Guideline on Credit Impairment Measurement and Income Recognition.

BOM set out some guiding principles when classifying for Stage 2 and Stage 3 in a COVID-19 context.

MUR 60bn for Economic Stabilization

USD 2bn at the disposal of the MIC to support economic operators with min. turnover of MUR 100m.

As countries have tightened their border controls, this pandemic has forced us to rethink the sustainability of an export-led economy. In the Budget 2020/21, we have noted that the Government has encouraged local production, diversified into strategic sectors like the Blue economy and pharmaceuticals as well as promote sustainable development 5. Even though Mauritius has been able to contain the impact of the COVID-19 pandemic, there are still some perceived risks looming for the FY21.

5 PwC Budget Brief 2020

Uncertain Outlook

The Governor stated in a press conference on the 8th of July 2020 that the forbearance period was extended for another 3 months, resulting in a total moratorium period of 9 months 6 . This extension was welcomed by many economic operators, especially those in the tourism sector. Nevertheless, it will now be difficult to assess the financial stability of economic operators post the moratorium period and Government Support Programme. There should be continuous assessments to determine whether some economic operators have experienced permanent damages.

On 7th May 2020, the European Union (“EU”) proposed a number of third countries to their list of countries which money laundering and terrorist financing deficiencies pose a significant threat to the financial system of the EU. The FATF’s report highlighted AML/ CFT deficiencies in Mauritius related to DNFBPs (Designated Non-Financial Businesses and Professions), i.e., lawyers, notaries, estate agents, accounting firms etc. and NOT banks. On the contrary, the report highlighted that most banks applied standards which went over and above regulatory requirements.

Currently, Mauritius is largely compliant with 35 out of the 40 recommendations and it has already met the FATF expectations in respect of the ‘Big Six Recommendations’. Mauritius is addressing the FATF concerns actively in order to be removed from the FATF grey list (and consequently the EU list) as quickly as possible.

The EU blacklist took effect as from the 1st October 2020.

The closure of borders has brought the tourism sector to a standstill. The recovery of this sector will be slow due to the fear of COVID-19 contamination among citizens and global travel restrictions.

We also need to keep in mind that restrictions might remain in place for longer than we expect if there is the re-emergence of the virus “second-wave”. Travelling quarantine policies have been set up for tourists and Mauritians entering the country but the impact of these policies on our tourism sector is yet to be determined.

Gradual Recovery in 2021

In the Budget 2020/21, the government aims to stimulate the economy through government spending by investing in major infrastructure in order to offset the negative effects of COVID-19 outbreak . Mauritius can expect a gradual recovery in 2021. Some sectors will recover more rapidly e.g. construction sector while others will have a more prolonged recovery phase e.g. the tourism industry.

6 MPC speech; 8th July 2020: https://www.bom.mu/media/speeches/mpc-meeting-press-statement-governor

7 Fitch Solutions: Mauritius Country Risk Report Q3 2020, Page 13

8 Fitch Solutions: Mauritius Country Risk Report Q3 2020, Page 12

CHIEF FINANCIAL OFFICER STATEMENT

The unanticipated COVID-19 virus has created much havoc, not only in our personal lives but also on the financial standing of the corporate world including the banking sector. Despite this unparalleled situation, the Bank ensured that it maintained the delivery of services to clients on the back of fast-tracked roll-outs of digital applications.

PERFORMANCE HIGHLIGHTS

| AFRASIA BANK LIMITED | 30 JUNE 2018 | 30 JUNE 2019 | 30 JUNE 2020 |

|---|---|---|---|

| STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME (MUR'm) |

|||

| Net interest income, calculated using EIR method | 1,710 | 2,311 | 2,028 |

| Non-interest income | 1,193 | 1,382 | 1,787 |

| Total operating income | 2,903 | 3,693 | 3,815 |

| Total operating expenses | 927 | 1,109 | 1,275 |

| Profit after tax after OCI | 766 | 1,579 | 1,502 |

| STATEMENT OF FINANCIAL POSITION (MUR'm) | |||

| Total assets | 120,400 | 139,873 | 160,473 |

| Loans and advances to banks and customers | 28,066 | 28,169 | 28,290 |

| Deposits from banks and customers | 111,385 | 131,208 | 150,947 |

| Total equity (including Class A shares) | 6,899 | 7,716 | 8,641 |

| PERFORMANCE RATIOS (%) | |||

| Return on average equity | 14 | 25 | 21 |

| Return on average assets | 0.7 | 1.2 | 1.0 |

| Loans-to-deposits ratio | 25 | 21 | 19 |

| Cost-to-income ratio | 32 | 30 | 33 |

| CAPITAL ADEQUACY RATIO (%) | |||

| Capital Management | 14.71 | 15.85 | 15.15 |

| AFRASIA BANK LIMITED AND ITS SUBSIDIARIES | 30 JUNE 2018 | 30 JUNE 2019 | 30 JUNE 2020 |

|---|---|---|---|

| STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME (MUR'm) |

|||

| Net interest income, calculated using EIR method | 1,706 | 2,311 | 2,028 |

| Non-interest income | 1,277 | 1,417 | 1,822 |

| Total operating income | 2,983 | 3,728 | 3,850 |

| Total operating expenses | 994 | 1,200 | 1,320 |

| Profit after tax after OCI | 763 | 1,627 | 1,528 |

| STATEMENT OF FINANCIAL POSITION (MUR'm) | |||

| Total assets | 121,961 | 141,361 | 160,477 |

| Loans and advances to banks and customers | 28,066 | 28,169 | 28,290 |

| Deposits from banks and customers | 111,136 | 131,033 | 150,922 |

| Total equity (including Class A shares) | 6,836 | 7,701 | 8,651 |

| PERFORMANCE RATIOS (%) | |||

| Return on average equity | 15 | 26 | 21 |

| Return on average assets | 0.7 | 1.2 | 1.0 |

| Loans-to-deposits ratio | 25 | 21 | 19 |

| Cost-to-income ratio | 33 | 32 | 34 |

| CAPITAL ADEQUACY RATIO (%) | |||

| Capital Management | 14.10 | 15.32 | 15.15 |

CURRENT YEAR PERFORMANCE AGAINST

OBJECTIVES AND FUTURE GROWTH

Statement of Profit or Loss and Other Comprehensive Income – Total Operating Income

| KPI | OUTCOME | TARGET FOR NEXT FY |

|---|---|---|

| Due to challenging market conditions, the Bank is expected to achieve a marginal growth in its total operating income for FY20 at MUR 3.9bn. | The Bank achieved a total operating income of MUR 3.8bn, that is, 3% under budget. | Due to impact of COVID-19 and growing uncertainty on the market, the Bank is expected to achieve a lower total operating income for FY21 standing at MUR 2.4bn vis-à-vis last year. |

PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME REVIEW

REVENUE

NET INTEREST INCOME

AfrAsia Bank reported a net interest income (“NII”) of MUR 2.0bn, that is, 12% lower than in the prior year. The year-on-year decrease was mainly driven by higher interest expense of MUR 1.1bn (2019: MUR 0.9bn). This effect was mainly on the back of the COVID-19 pandemic creating trade related uncertainty plunging the average volume and balances of placements and bonds due to financial market volatility and erosion of market value both in the domestic as well as international markets. Terms of many financial assets had to be renegotiated leading to dwindling interest income on customer grounds. While the Bank coped to manage its interest income, the growth in interest expense was the final knockback which dragged the net interest income down.

FINANCIAL POSITION REVIEW

TOTAL ASSETS

The Bank’s asset base grew by 15% (MUR 20.6bn) and reached MUR 160.5bn by end of this year under review. This growth was primarily in cash and cash equivalents and due from banks and investment securities, while loans and advances and other assets were relatively stable when compared to last FY.

The bisection of the asset book sat in cash and cash equivalents and due from banks with an increase of MUR 16.5bn in 2020 as compared to the prior year. Investment securities increased by MUR 3.4bn (7%) primarily to upper possession of debt instruments at amortised cost; representing 30% of total assets.

Other assets, with its foremost component being mandatory balances with the Central Bank (MUR 2.2bn), did not experience major change. Furthermore, the proportion of the Bank’s total assets to Segment B represented 65% in 2020 which represents a slight increase when compared to 64% in 2019.