PRINCIPLE TWO – THE STRUCTURE OF THE BOARD AND ITS COMMITTEES

The Board is responsible for the overall stewardship of the Bank and thus plays a vital role in ensuring that the appropriate level of corporate governance is maintained.

The powers of Directors are set out in the Bank’s Constitution and in the Terms of Reference for the Board. The Board is aware of its responsibilities to ensure that the Bank adheres to all relevant legislations such as The Banking Act 2004 (amended August 2020), the Financial Reporting Act 2004 (amended 2018), the Financial Services Act 2007 and The Companies Act 2001 of Mauritius. The Board reassesses its Terms of Reference as and when required.

The Board also follows the principle of good corporate governance as recommended in the “National Code of Corporate Governance 2016” and BOM’s “Guidelines on Corporate Governance 2001” (revised October 2017). It reviews and approves whenever deemed necessary the Bank’s Code of Ethics to warrant that they are in line with the Bank’s objectives and also monitors and evaluates the Bank’s compliance with its Code of Ethics.

- Determining the Bank’s purpose, strategy and values - the Board is responsible to set the long-term goals, do the strategic planning and propose action plans;

- Monitoring and evaluating the implementation of strategies, policies, management performance criteria and business plans - the Board must provide guidance and maintain effective control over the Company, and monitor management in carrying out Board’s plans and strategies;

- Exercising leadership, enterprise, intellectual honesty, integrity, objectivity and judgment in directing the Company as to achieve sustainable prosperity for the Company;

- Ensuring that procedures and practices are in place to protect the Company’s assets and reputation. Thus, the Board must regularly review processes and procedures to guarantee the effectiveness of the Company’s internal control systems;

- Considering the necessity and appropriateness of installing a mechanism by which breaches of the principles of Corporate Governance could be reported;

- Defining levels of materiality, reserving specific powers for itself and delegating other related matters with the necessary written authority to the management. These matters should be monitored and evaluated by the Board on a regular basis. Such delegation by the Board must have due regard for the Directors’ statutory and fiduciary responsibilities to the Company, while taking into account strategic and operational effectiveness and efficiency;

- Retaining full and effective control over the Company and be responsible for the appointment and monitoring of management in its implementation of the Board’s approved plans and strategies;

- Questioning, scrutinizing and monitoring, in a pro-active manner the performance of management, the Board subcommittees and the individual Directors;

- Always remaining responsible for the overall stewardship of the Company and must be ready to question, scrutinize and monitor, in a proactive manner, management’s performance;

- Identification of key risk areas and key performance indicators of the business enterprise to enable the Company to generate economic profit and eventually to enhance shareholders’ value in the long-term. The interests of society at large must also be recognised;

- Ensuring that the Company’s policies and systems are effective enough to achieve a prudential balance between the risks and potential returns to the shareholders;

- Ensuring that the Company’s operations are conducted prudently and within the framework of laws and Board policies and that any deviation is reported to an appropriate level of management, or if necessary, to the Board;

- Ensuring the integrity of the institution’s risk management practices and internal controls, communication policy, Director selection, orientation and evaluation;

- Ensuring that the necessary internal controls and management systems are put in place to monitor effectively the operations and to ensure that the Company complies with all relevant laws, regulations, codes of best business practice and policies;

- Recording of the facts and assumptions on which the Board relies to conclude that the business will or will not continue as a going-concern in the financial year ahead. If not, the Board must record the steps it is taking;

- Monitoring and assessing risks in order to achieve the continuous viability of the Company at all times;

- Setting a policy in relation to the frequency, purpose, conduct and duration of the Board’s and the Committees’ meetings;

- Ensuring that there are efficient and timely dissemination and briefings of information to the Board Members before any meeting. This must also include an agreed procedure whereby the Directors can obtain appropriate independent professional advice at the Company’s expense when necessary;

- Enabling Non-Executive Directors get access to management without the presence of the Executive Directors. This procedure must be agreed collectively by the Board;

- Regular identification, monitoring and reporting of the non-financial aspects relevant to the Company’s business;

- Ensuring that it communicates with the shareholders and the relevant stakeholders (internal and external) openly and promptly with substance prevailing over form. Proper means of communication to be put in place so as to both communications with and to receive feedback from the shareholders and other stakeholders;

- Appointing a Chief Executive Officer and to satisfy itself of the integrity of the Chief Executive Officer. Moreover, the Board must ensure that the succession is professionally planned in a timely manner;

- Appointing Company Secretary and in so doing satisfy itself that the appointee is fit and proper and has the requisite attributes, experience and qualification to properly discharge his/ her duties;

- Balancing between ‘CONFORMANCE’ and ‘PERFORMANCE’. Conformance is compliance with the various laws, regulations and codes governing companies. Ensuring the performance requires the development of a commensurate enterprise culture within the organisation so that returns to shareholders are maximised while respecting the interests of other stakeholders; and

- Contributing fully in developing and sustaining the enterprise culture. Thus, the Board must be constituted in a manner that provides a balance between enterprise and control.

The Terms of Reference is available for consultation on the Bank’s website. (https://www.afrasiabank.com/en/about/corporate-governance/governance-framework)

As per The Companies Act 2001 of Mauritius, the Terms of References and the Bank’s Constitution, decisions also requiring prior approval of the Board includes the following:

- Issue of other shares;

- Consideration for issue of shares;

- Shares not paid for in cash;

- Authorisation of distribution;

- Shares issued in lieu of dividend;

- Shareholder discount;

- Purchase of own shares;

- Redemption at option of Bank;

- Restrictions on giving financial assistance;

- Change of Registered Office;

- Approval of amalgamation proposal;

- Short form amalgamation; and

- Transfer of shares.

COMPOSITION OF THE BOARD

The Constitution of AfrAsia Bank Limited provides for a board comprising a minimum of 5 Directors and a maximum of 14 Directors. As at 30 June 2020, the Bank had a unitary board of ten experienced, well-known and high caliber members from both local and international frontiers with the right balance in knowledge, skills and expertise across various sectors. In line with BOM’s “Guidelines on Corporate Governance 2001” (revised October 2017) issued by the Bank of Mauritius, AfrAsia Bank Limited satisfies the minimum percentage of Non-Executive Independent Directors as at 30 June 2020, as portrayed below:

Board Representation as at 30 June 2020 was as follows:

Non-Executive

Directors

Independent

Non-Executive Directors (Including Chairman)

Executive

Director / CEO

The Board is of the credence that based on the size of the Bank and its relative shareholding structure, there is an apposite representation in terms of the balance of Executive, Non-Executive and Independent Non-Executive Directors and the skills, knowledge and experience of its Directors who, collectively provide the core abilities for the headship of the Bank.

As per the Code of Corporate Governance, all boards should have a strong executive management presence with at least two Executives as members. The Board is of the view that the spirit of the Code is met through the attendance and/or participation of the CEO as Executive Director and the Senior Management in relevant Committees and Board deliberations as and when required.

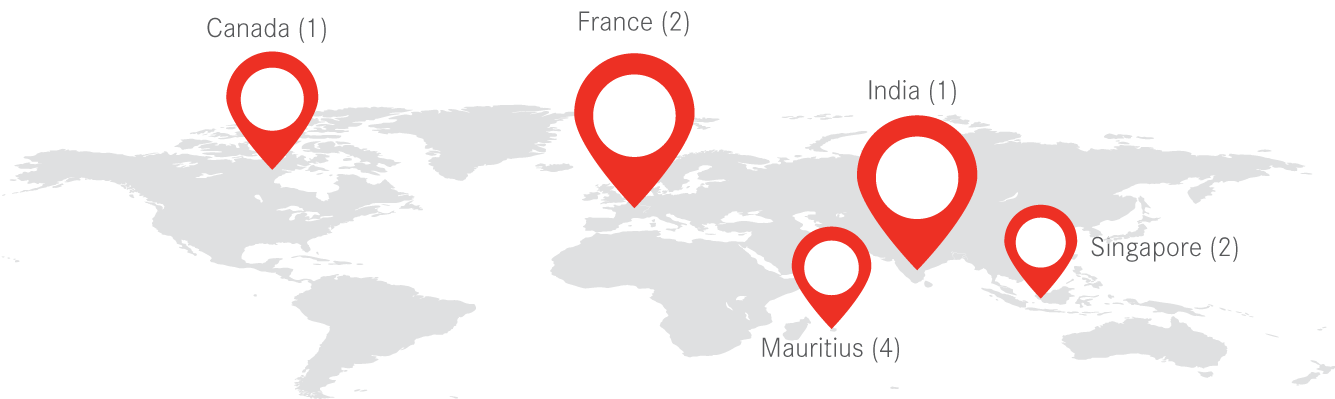

Directors’ country of residence as at 30 June 2020 was as follows:

Directors’ length of tenure on the Board as at 30 June 2020 was as follows:

1 - 3 YEARS

3 - 5 YEARS

> 5 YEARS

Subsequent to 30 June 2020, the following changes occurred on the Board composition:

| Name | Directorship | Change | Effective Date |

|---|---|---|---|

| Arvind Madan Sethi | Independent Non-Executive Director | Resignation | 15-Jul-20 |

| Jean Juppin De Fondaumière | Independent Non-Executive Chairman | Resignation | 31-Aug-20 |

| Mathew Welch | Independent Non-Executive Director | Resignation | 03-Sep-20 |

| Sanjiv Bhasin | Executive Director | Resignation | Note 1 |

| Martin Caron | Non-Executive Director | Resignation | 28-Sep-20 |

| Yves Jacquot* | Non-Executive Director | Resignation | 28-Sep-20 |

| Philippe Jewtoukoff | Independent Non-Executive Director | Resignation | 28-Sep-20 |

| Dipak Chummun | Non-Executive Director | Resignation | 02-Oct-20 |

| Arnaud Lagesse | Non-Executive Director | Resignation | 02-Oct-20 |

| Francois Wertheimer | Non-Executive Director | Resignation | 02-Oct-20 |

*Dominic Jacques, alternate Director to Yves Jacquot, has by default resigned on 28 September 2020.

Note 1: The effective date of resignation as Executive Director being the date when the contract of employment expires or is terminated (refer to page 54 for such information).

A Special Meeting of shareholders was convened on 29 September 2020, wherein 9 new Directors were appointed along with the clearance of the Bank of Mauritius and the approval of Financial Services Commission. These Directors will hold office until the annual meeting of the Bank to be held in 2021:

| Name | Directorship | Change | Effective Date |

|---|---|---|---|

| Isabelle Marie Edith Alvares Pereira De Melo | Non-Executive Director | Appointment | 02-Oct-20 |

| Inderjit Singh Bedi | Independent Non-Executive Director | Appointment | 02-Oct-20 |

| Brian Adam Davis | Non-Executive Director | Appointment | 02-Oct-20 |

| Afsar Azize Abdulla Ebrahim | Director* | Appointment | 02-Oct-20 |

| Aslam Kanowah | Non-Executive Director | Appointment | 02-Oct-20 |

| Christian St-Arnaud | Non-Executive Director | Appointment | 02-Oct-20 |

| Jan Fredrik Louis Gaëtan Boullé | Non-Executive Director | Appointment | 09-Oct-20 |

| Giriraj Sinh Jadeja | Independent Non-Executive Director | Appointment | 22-Oct-20 |

| Jean-Raymond Rey | Non-Executive Director | Appointment | 05-Nov-20 |

*At the date of approval of this report, the independence status of the Director is still under assessment by BOM.

Joan Jill Wan Bok Nale was appointed by the Board of Directors as an Independent Non-Executive Director with an effective appointment date of 5 November 2020.

The Board acknowledges that the provision of Part XI (Sub-Part C) (133) (Appointment and removal of Directors) of The Companies Act 2001 of Mauritius which aims at the requirement for gender representation for an optimal Board diversity, is part of its objectives to achieve. While as at 30 June 2020, the Board did not find an apt candidate to fill the role, following the recomposition of the Board, two female Directors were appointed to uphold the required multiplicity of the latter.

In line with BOM’s “Guidelines on Corporate Governance 2001” (revised October 2017) issued by the Bank of Mauritius, more specifically Section 18(3) of The Banking Act 2004 (amended August 2020) which stipulates that the Board of Directors of a financial institution incorporated in Mauritius should consist of at least 5 natural persons, 40 per cent of which must be Independent Directors, AfrAsia Bank Limited is currently not satisfying the minimum percentage of Independent Non-Executive Directors. The Bank has acknowledged and advised BOM of this current non-adherence. It will require 2 additional Independent Non-Executive Directors to address this composition deficiency.

DIRECTORS’ PROFILES

The profiles of the current Directors of the recomposed Board are as follows:

As at 30 June 2020, the following members served on the Board and their profiles were as follows:

Note: The ‘Length of service as Director’ for the Board runs from the time of first appointment to the 30th of June 2020 for those who held office as at 30 June 2020.

BOARD COMMITTEES

AfrAsia’s Board Committees are set up to enable the Board to discharge its roles and responsibilities through delegated authority and ingrained reporting instruments necessary for managing, directing and supervising the management of the business and affairs of the Bank. During the year under review, the Technology, Digitalization and Platforms Committee was established to canalise the technological needs of the Bank through one spectrum.

The Bank has in place six comprehensively structured Board Committees for more in-depth analysis and evaluation of various issues as may be appropriate. After each meeting, a report is made by each Board Committee and presented to the main Board for further discussion and/or approval by the Board. Each Committee operates under its own approved Terms of Reference which are subject to reassessment as and when required.

The Bank’s Board Structure as at 30 June 2020 is as follows:

BOARD MEETINGS

During the year under review, the Board held eleven meetings. The Board manages a schedule for the meetings with enough leeway for any additional issues arising to be included in the agenda as and when required in line with the Bank’s constitution. Decisions are also taken by way of resolutions in writing, assented and signed by all the Directors.

ATTENDANCE REPORT

The attendance report of the Directors at Board and Committee meetings for the year ended 30 June 2020 are tabulated below:

| Board of Directors |

Audit Committee |

Corporate Governance Committee |

Conduct Review Committee |

Credit Committee |

Risk Management Committee |

TDP* | |

|---|---|---|---|---|---|---|---|

| No. of meetings held | 11 | 4 | 4 | 4 | 7 | 6 | 3 |

| Jean Juppin De Fondaumière (Chairperson) | 11 | 4 | 4 | 4 | - | - | 3 |

| Sanjiv Bhasin (Chief Executive Officer) | 7 | - | 4 | - | - | 6 | 2 |

| Martin Caron | 11 | - | - | - | - | 6 | 3 |

| Dipak Chummun | 11 | - | - | - | 5 | - | - |

| Yves Jacquot | 11 | - | 4 | - | 7 | - | - |

| Philippe Jewtoukoff | 11 | 4 | 1 | 4 | 7 | - | - |

| Arnaud Lagesse | 9 | - | 4 | - | - | - | - |

| Arvind Madan Sethi | 11 | 3 | 1 | - | 1 | 6 | - |

| Mathew Welch | 11 | 4 | 1 | 4 | 7 | 6 | 3 |

| Francois Wertheimer | 11 | - | 4 | - | - | 6 | 3 |

*The Technology, Digitization and Platforms (TDP) Committee was set up during the year under review as part of the Committees’ panorama.

REMUNERATIONS AND BENEFITS

The remuneration and benefits paid and payable to the Directors for the year ended 30 June 2020 are tabulated below:

| Remuneration and benefits paid and payable (MUR’000) | |||

|---|---|---|---|

| Fixed | Variable | Total | |

| Jean Juppin De Fondaumière (Chairperson) | 7,922 | - | 7,922 |

| Sanjiv Bhasin (Chief Executive Officer) | 20,272 | - | 20,272 |

| Martin Caron* | - | - | - |

| Dipak Chummun | 1,413 | 360 | 1,773 |

| Yves Jacquot | 1,470 | 880 | 2,350 |

| Philippe Jewtoukoff | 1,413 | 1,170 | 2,583 |

| Arnaud Lagesse | 660 | 270 | 930 |

| Arvind Madan Sethi | 993 | 790 | 1,783 |

| Mathew Welch | 1,372 | 1,405 | 2,777 |

| Francois Wertheimer | 651 | 675 | 1,326 |

*The Director has opted to waive any compensation for acting as Director, partner or officer of AfrAsia Bank Limited.

COMPANY SECRETARY

The Company Secretary aids and provides guidance to the Board of Directors in a number of key areas, for instance, corporate law, governance and corporate secretarial practice. The Company Secretary also helps the Directors to fulfill their duties while acting with the utmost integrity and independence in the best interest of the Bank.

It has also a key role to play in the application of corporate governance within the Bank.

The duties of the Company Secretary include but is not limited to the following:

- To provide the Board with guidance as to its duties, responsibilities and powers;

- To inform the Board of all legislation relevant to or affecting meetings of shareholders and Directors and reporting at any meetings and the filing of any documents required of the Bank and any failure to comply with such legislation;

- To ensure that minutes of all meetings of shareholders or Directors are properly recorded and all statutory registers be properly maintained;

- To certify in the annual financial statements of the Bank that the Bank has filed with the Registrar of Companies all such returns as are required of the Bank as per the laws and regulations;

- To ensure that a copy of the Bank’s annual financial statements and the annual report are sent to every person entitled to such statements or report in accordance to the laws and regulations;

- To ensure that there is a good communication flow within the Board, the Board Committees and between the management and the Non-Executive Directors; and

- To advise the Board on all governance matters.

From July 2019 till December 2019:

During the above period, the Bank’s secretarial functions was outsourced to IBL Management Ltd through its representatives, Doris Dardanne, FCIS and Melanie Kye Thiam, FCIS.

Doris Dardanne is a Chartered Secretary and Fellow Member of the Institute of Chartered Secretaries and Administrators (UK). Doris has been working in the company secretariat field for nearly 34 years and is presently the Group Corporate Secretary of IBL Ltd, the largest Mauritian company listed on the Stock Exchange of Mauritius with activities in 9 different clusters and in 22 countries. As such, she has a wide exposure and a good knowledge of the different business sectors.

Melanie Kye Thiam holds a BA (Hons) in Law and Management and is a Chartered Secretary and Fellow Member of the Institute of Chartered Secretaries and Administrators (UK). Melanie is presently working as Company Secretary at IBL Ltd and has been providing company secretarial services to various companies within IBL Group operating in various sectors, for instance, financial services, logistics, aviation, retail and commerce. She also worked in the Global Business Sector for nearly 5 years.

IBL Management Ltd resigned as the Company Secretary of the Bank effective December 2019.

From December 2019 till date:

Consequently, the Bank appointed Neeven N. Parsooramen to fulfil the company secretarial duties and Usha Bhurtun as alternate company secretary.

Neeven N. Parsooramen is a Barrister-At-Law duly admitted to the Roll of the Supreme Court of Mauritius and also admitted to the bar of England and Wales. He read for a B.A in Law & Accounting and Finance (Hons) and also an LLM in International Economic and Trade Law in the UK. Having been admitted at the bar of Mauritius since 2011, he has been practicing as a barrister since and appears regularly before the courts of Mauritius. Neeven has a growing litigation practice where he appears regularly as counsel in commercial and civil matters.

Neeven also provides corporate and commercial legal advice in domestic and cross-border transactional matters. Neeven is also appointed as Director to a number of Board of Directors and also act as Company Secretary of a number of companies.

Usha Bhurtun is a practising Barrister-At-Law, who specialises in Commercial and Civil Litigation. Usha read Law in England, and holds an LL.B (Hons) from the London School of Economics and Political Science (L.S.E) and an LL.M with Distinction, from City Law School, London. She has been admitted to the Bar of England and Wales in 2015 and to the Bar of Mauritius in 2016.

Usha is regularly instructed to appear before all the Courts of Mauritius and acts as junior Counsel on behalf corporations and private clients, in matters of commercial disputes and civil claims.

Neeven resigned as the Company Secretary of the Bank and he will serve his period of notice until December 2020.